In a surprising revelation, popular Korean actress Jung Eun Chae has confirmed her romantic...

In the diverse tapestry of Indian politics, certain figures emerge not only as leaders...

GitHub has issued a crucial warning to its users, urging them to prioritize the...

Nestled on the western coast of India, overlooking the Arabian Sea, stands the illustrious...

The Sellafield nuclear site fell victim to a sophisticated cyberattack orchestrated by hacking groups...

Nestled amidst the lush green forests of Madhya Pradesh lies the quaint little town...

A Zimbra zero-day vulnerability has been uncovered, posing a significant threat to organizations relying...

In an unexpected turn of events, Dubai witnessed unprecedented heavy rainfall, leaving residents astonished...

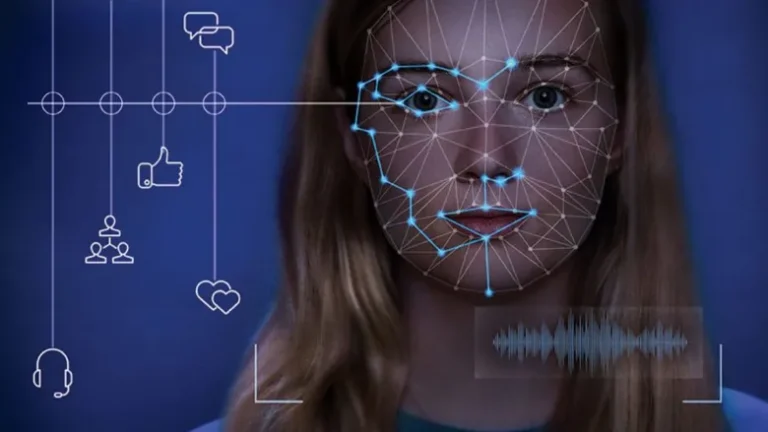

Deepfake technology, a rapidly evolving branch of artificial intelligence (AI), has garnered significant attention...

The global IT giant Infosys has been thrust into the spotlight as its US...